The transportation of dangerous goods is an essential practice in many industries, but it requires in-depth knowledge and the adoption of rigorous safety regulations.

In this comprehensive guide, we will explore the fundamentals of dangerous goods transportation, focusing on the importance of Kemler codes, the ADR table, and the key regulations that govern their management. Furthermore, we will provide valuable tips on how to handle dangerous goods safely and responsibly.

Understanding Kemler codes

In the transportation of dangerous goods, safety is an absolute priority. In this context, Kemler codes – internationally known as UN codes – represent the fundamental element to successfully achieve maximum safety.

These codes are a classification system for dangerous goods, in which each harmful substance or material is assigned a specific Kemler code that identifies its characteristics and the necessary precautions for safe transportation. For example, the first number of the code indicates the main danger class of the substance, while the second number represents the sub-danger class. The third number provides additional information, such as storage conditions and safety measures.

This type of code is essential, especially to allow anyone involved in the supply chain to immediately understand the type of risk posed by the cargo. It is, in fact, crucial, to ensure safety during transportation, that Kemler codes are correctly applied to dangerous goods. This implies that labeling is correct and clearly visible, documentation is accurate, and all transport regulations, including packaging requirements and emergency procedures, are adhered to.

The ADR table: regulations for safe transportation

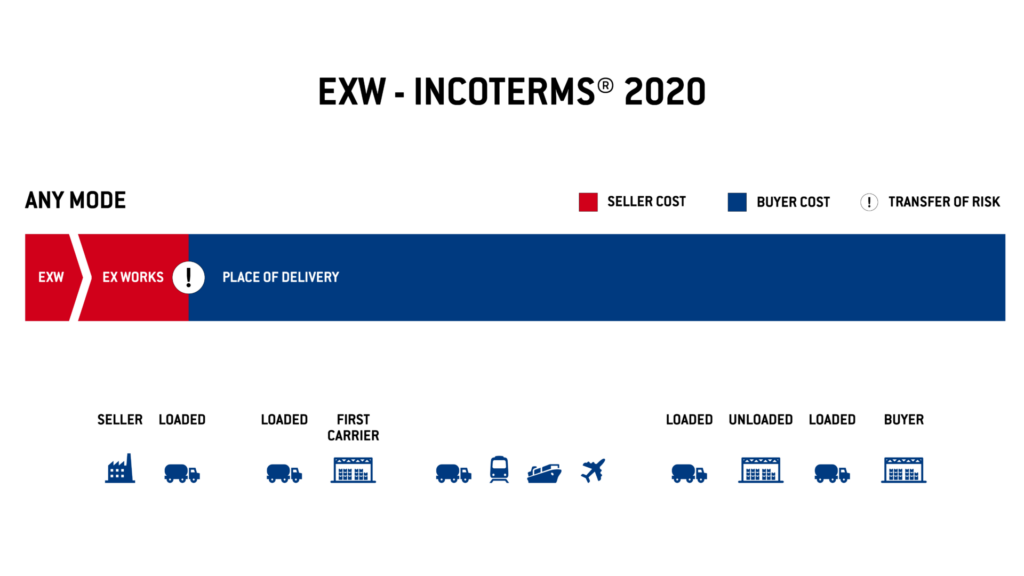

The ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road) is a multilateral agreement developed by the United Nations that establishes safety standards to be respected by all signatory countries, ensuring a uniform basis for the safe transportation of dangerous goods throughout Europe.

Specifically, the ADR table, a key tool within this agreement, is the official reference document that provides a series of mandatory guidelines, regulations, and detailed requirements to ensure extreme safety in cargo transportation.

The table, divided into various sections, addresses specific aspects of transportation, including labeling, packaging, classification of goods, documentation, emergency procedures, and much more.

Knowledge of the ADR table is essential for anyone involved in the transportation of dangerous goods, in order to ensure the safety of operations and compliance with regulations. Adhering to ADR provisions requires training, constant awareness, and the adoption of practices that conform to the various provisions.

List of main dangerous goods codes

The world of dangerous goods transportation is characterized by a wide range of substances and materials, each with its own risks and specific safety measures.

Knowing the most common Kemler codes and the key precautions to be taken during their transportation is of fundamental importance to avoid accidents and hazardous situations.

- Kemler Code 3 – Flammable Liquids. Precautions include the use of special containers, transportation in fire-prevention vehicles, and adherence to distances from heat sources.

- Kemler Code 6 – Toxic and Infectious Substances (for human health). Precautions include correct labeling, the use of personal protective equipment, and rigorous procedures to prevent contamination.

- Kemler Code 8 – Corrosive Materials. Precautions involve the use of corrosion-resistant containers, isolation from other goods, and measures to prevent leaks and skin contact.

Regulations and Safety in Transportation

Compliance with regulations related to the transportation of dangerous goods is essential to ensure the safety of operators, the surrounding environment, and the involved communities.

In this process, freight forwarders play a crucial role: they are responsible for planning, organizing, and executing transportation operations, including the classification of goods, packaging and loading, documentation, and driver training.

Similarly, drivers play a key role in the practical application of regulations and precautions. They must be adequately prepared to handle unforeseen situations – such as leaks, fires, or exposures – and ensure the safety of operations.

How to handle dangerous goods

Managing dangerous goods is a complex task that requires attention to detail and strict adherence to safety regulations and procedures. Practical guidelines for handling them correctly encompass all critical phases of the operation: from packaging to labeling, from secure loading to proper transportation, to emergency procedures.

Do you want to transport dangerous goods but don’t know who to turn to? Contact CTI, our team of experts will be at your complete disposal to ensure maximum safety and regulatory compliance. Safety begins with knowledge, and we are here to help you ensure it in all transportation operations.